are inherited annuities tax free

In turn taxation of annuity distributions. Answer Simple Questions About Your Life And We Do The Rest.

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

. Make Your Money Work Smarter And Get Guaranteed Monthly Income For Life. Ad Learn some startling facts about this often complex investment product. Get Your Max Refund Today.

Personalized Reports Get the Highest Guaranteed Return. Depending on the type of annuity the tax will have to be paid on the lump sum received or on the regular fixed. Inherited annuities are taxable as income.

The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Youd have to pay any taxes due on the benefits at the time you receive them. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would.

Ad Learn More about How Annuities Work from Fidelity. The earnings are taxable over the life of the payments. Annuities are taxed as ordinary income when inherited.

To avoid taxes on an inheritance for your beneficiaries utilize a deferred annuity or a life insurance policy. Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. While its not possible to completely avoid taxes on an.

By The Money Farm Team. File Your Tax Forms Today. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

11 Little-Know Tips You Must Know Before Buying. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. Tax Consequences of Inherited Annuities Different tax consequences exist for spouse versus non-spouse beneficiaries.

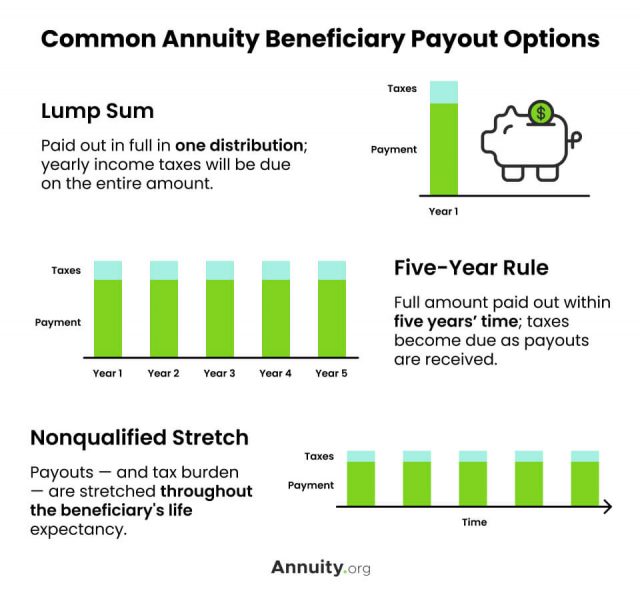

But without thoughtful consideration for tax implications it could be a bust. As a result inherited annuities are subject to tax. Depending on the payout option selected the beneficiary of a tax-deferred annuity will be taxed differently on the income received.

Tax-deferred annuity beneficiaries can pick from a variety of payment alternatives that will affect how the. Ad Safe Retirement Planning. When a person inherits an annuity the gains stay with the policy.

Ad Learn More about How Annuities Work from Fidelity. The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed. Annuities offer enhanced death benefits to allow beneficiaries to offset.

Ad Get unlimited free live expert assistance along with lower federal filing prices. If a beneficiary opts to receive the money all at once he or she must pay taxes. Surviving spouses can change the original contract.

File for less than the big guys and get more with TaxAct. You could opt to take any money remaining in an inherited annuity in one lump sum. A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. If you have a 500000 portfolio get this must-read guide from Fisher Investments. These annuities have already been subject to income tax however any.

Inheriting an annuity can be a financial boon. The income from an inherited annuity is taxed. Dont Buy An Annuity Until You Review Our Top Picks For 2022.

The proceeds of an inheritance are taxable.

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts

Inherited Annuity Tax Guide For Beneficiaries

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

We Have Long Term Care Annuities That Double Or Triple Your Client S Premium For A Tax Free Long Term Care Benefit Annuity Retirement Planning Long Term Care

Inherited Annuity Tax Guide For Beneficiaries